yoga-dlya-novichkov.ru News

News

Prepaid Credit Card Help Credit Score

Typically, using prepaid credit cards won't help you build credit. However, KOHO prepaid cards are different. A secured credit card is an appropriate option for building or rebuilding credit if your goal is to establish a credit history or boost your credit score. If. A prepaid card is not based on credit, which means you don't need to have a good credit history to get one. However, this also means that it won't help you to. Secured credit cards are a different type of credit card designed to help you establish credit and can be used to improve your credit score. Make purchases like with any credit card · Build your credit by making on-time payments · Earn 3% and 2% Cash Back on your choice of Spend Categories. Plus, you. They do not help you establish or improve your credit: The companies that issue your prepaid cards will not report your spending habits to the credit bureaus. When managed responsibly, a credit card can help build and improve your credit score, making it easier to secure loans and credit cards, now and in the. From no credit, what is the best prepaid credit card to get approved online with low income and no credit? Also if it could be one that would. Even if you tuck the card away, those monthly transactions and on-time payments should help you on your journey to a good credit score. 5. Increase your credit. Typically, using prepaid credit cards won't help you build credit. However, KOHO prepaid cards are different. A secured credit card is an appropriate option for building or rebuilding credit if your goal is to establish a credit history or boost your credit score. If. A prepaid card is not based on credit, which means you don't need to have a good credit history to get one. However, this also means that it won't help you to. Secured credit cards are a different type of credit card designed to help you establish credit and can be used to improve your credit score. Make purchases like with any credit card · Build your credit by making on-time payments · Earn 3% and 2% Cash Back on your choice of Spend Categories. Plus, you. They do not help you establish or improve your credit: The companies that issue your prepaid cards will not report your spending habits to the credit bureaus. When managed responsibly, a credit card can help build and improve your credit score, making it easier to secure loans and credit cards, now and in the. From no credit, what is the best prepaid credit card to get approved online with low income and no credit? Also if it could be one that would. Even if you tuck the card away, those monthly transactions and on-time payments should help you on your journey to a good credit score. 5. Increase your credit.

Experience the freedom of a dynamic credit line.2 Add funds to your Secured Account to increase your credit limit as needed. Your score matters. You can use your credit card to make purchases, and they are very convenient. One way to start a credit history is to have one or two department store or gas. There's no way for you to improve your credit score through regular use of a prepaid credit card, since it's not actually a credit product. Click here to see. If you have no credit or are trying to improve your credit score, using a help because credit card companies will report your payment activity to the credit. Using a debit card to access money you already have in your bank account to pay for items won't impact your credit reports or credit scores. For comparison. Canada Post Prepaid Reloadable Visa® card · No credit check or interest charges · Ideal for budgeting and paying bills · Great for depositing Government Issued. Build your credit. Unlike most debit or prepaid cards, the Key Secured Credit Card is a real credit card that reports your history to credit bureaus. Make. A secured credit card is an appropriate option for building or rebuilding credit if your goal is to establish a credit history or boost your credit score. If. In the long run, you may find that your prepaid business credit cards build credit indirectly by helping you make better spending decisions with other payment. We monitor your activity and regularly report your card status to the three major credit bureaus. Spend within your limit and pay your bill when it's due. Over. Prepaid credit cards will NOT help boost your credit score. They're basically glorified gift cards. Once the funds expire, you can reload it. Prepaid cards do not have an impact on your credit score because when you spend on them, you are not borrowing money. Any money you borrow — be it a credit card. Did you Know a Prepaid Card Could Help You to Improve Your Credit Score? | Learn More About Prepaid Cards & Why They're Perfect if You Want to Build Your. Even if you tuck the card away, those monthly transactions and on-time payments should help you on your journey to a good credit score. 5. Increase your credit. You can use prepaid cards online or when you can't pay in cash, but they won't help your credit score. "Prepaid cards can be purchased at banks, discount . From no credit, what is the best prepaid credit card to get approved online with low income and no credit? Also if it could be one that would. Extra members who use the product as recommended were more likely to achieve and maintain good credit scores than consumers who demonstrated healthy credit. For this reason, secured cards provide you with an opportunity to make consistent on-time payments and improve your credit score over time. But eventually, you'. Credit cards to help build or rebuild credit can create a successful financial future when handled responsibly. See more. PREMIER Bankcard® Grey Credit Card · Pre-qualify with no impact to your credit score · Helping people build credit is our first priority – start your credit-.

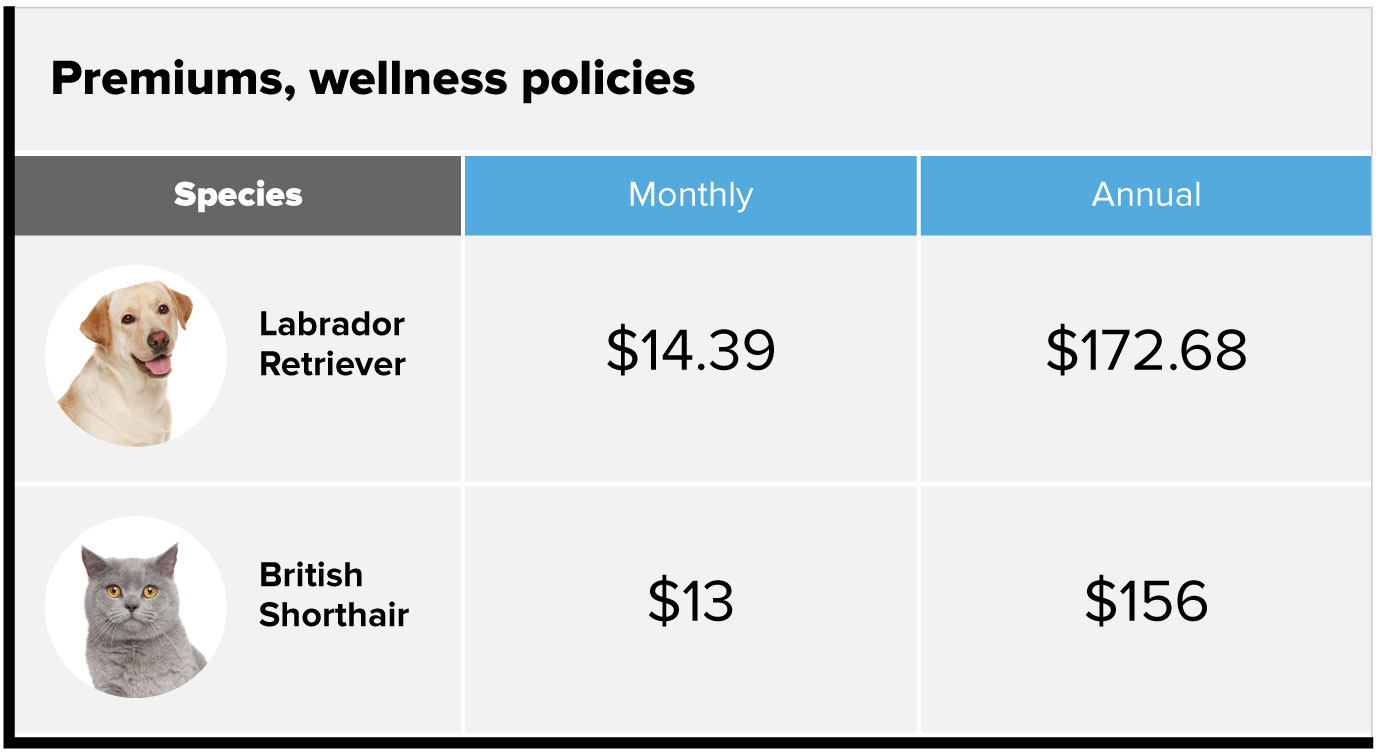

How Much Is The Pet Insurance

The cost of pet insurance varies based on many factors. As with other insurance you may have, you'll likely pay an annual or monthly premium to keep your pet. The Accident Only pet insurance plan is only $10 or less a month, regardless of your dog or cat's age or breed. keyboard_arrow_down What isn't covered by pet. Our most popular plans are about $20/month. Call for a quote: How are my premiums determined? The average cost of an accident and illness pet policy was $ per month for a dog in , or $ per year, according to the North American Pet Health. The average monthly cost of pet insurance in New York is: $ for a kitten, $ for a 5-year-old cat, and $ for a year-old cat; $ for a. Nationwide protects more than 1,, pets · Complete coverage. · Complete confidence. · How pet insurance works · Frequently Asked Questions. The average cost of dog insurance hovers around $88 per month, according to quotes analyzed by Investopedia. But much like our canine companions, rates vary. On average, comprehensive coverage costs $ for dogs and $ for cats each year. These policies may exclude pets with pre-existing or genetic conditions. How much does pet insurance cost? With Fetch, the average cost of dog insurance is $35 per month and the average cost of cat insurance is $20 per month. But. The cost of pet insurance varies based on many factors. As with other insurance you may have, you'll likely pay an annual or monthly premium to keep your pet. The Accident Only pet insurance plan is only $10 or less a month, regardless of your dog or cat's age or breed. keyboard_arrow_down What isn't covered by pet. Our most popular plans are about $20/month. Call for a quote: How are my premiums determined? The average cost of an accident and illness pet policy was $ per month for a dog in , or $ per year, according to the North American Pet Health. The average monthly cost of pet insurance in New York is: $ for a kitten, $ for a 5-year-old cat, and $ for a year-old cat; $ for a. Nationwide protects more than 1,, pets · Complete coverage. · Complete confidence. · How pet insurance works · Frequently Asked Questions. The average cost of dog insurance hovers around $88 per month, according to quotes analyzed by Investopedia. But much like our canine companions, rates vary. On average, comprehensive coverage costs $ for dogs and $ for cats each year. These policies may exclude pets with pre-existing or genetic conditions. How much does pet insurance cost? With Fetch, the average cost of dog insurance is $35 per month and the average cost of cat insurance is $20 per month. But.

Pet insurance costs $55 per month on average for an unlimited accident and illness plan for a dog and about $47 per month for a cat. But how much you'll pay for. The GEICO Insurance Agency can help you get comprehensive pet insurance coverage for your dogs and cats. Get a free online quote and see how affordable pet. The average accident and illness plan pet insurance premium in was $ per month for dogs, and $ for cats. The average cost for pet insurance is $ per month for dogs and $ per month for cats. The species, breed, age, and location of. The average monthly cost of pet insurance in New York is: $ for a kitten, $ for a 5-year-old cat, and $ for a year-old cat; $ for a. The monthly premium depends on the type of coverage selected. Our most popular coverage starts at around $90/month for two dogs, which includes a 5% multi-pet. How Progressive Pet Insurance by Pets Best compares · One annual deductible · Fast claims processing and payment · No upper age limits · Optional exam fee coverage. How Much Does Pet Insurance Cost on Average in the US? The average monthly pet insurance premium is $ for dogs and $ for cats, according to the. You can rest easy knowing your dogs and puppies are protected from head to tail with MetLife Pet Insurance. Starting at $15 a month. Enjoy unlimited payouts on covered cost. Your coverage won't be dropped no matter how many claims you file. Rated #1 by vets. Trupanion medical insurance. How much is pet insurance in New York? The average cost of pet insurance in New York is $92 a month for an accident and illness plan with unlimited coverage. Pet insurance reimburses 70%, 80%, 90%, or even % of unexpected veterinary costs depending on your plan. Pawlicy Advisor is a free service that will help you. Pay a known fixed cost to reduce the risk of a big cost. For me, I self-insure. But part of this is the type of pets I get. I've adopted animals. We love Figo! I am so happy with pet insurance because having a sick pet is scary enough. Not knowing how to pay to get the care your pet needs is even. How much is pet insurance for cats? According to data provided by NAPHIA for the year , the annual cost for cat owners is an average of $, while the. Pet owners trust Nationwide to protect more than 1,, pets · Pet insurance premiums starting at $25/mo. · Visit any licensed veterinarian in the United. How much does pet insurance cost? Most pet owners pay between $30 and $50 per month for their pet health plan, depending on your pet's age, species, breed and. Give yourself the freedom to focus on your pet's health — instead of how to pay for it — with affordable pet insurance. Understand pet insurance cost and. Premiums for pet health insurance are based primarily on your dog or cat's age, breed, location, and your plan's annual limit, deductible, and reimbursement. Pet health insurance helps you mitigate unexpected costs and manage vet bills so you're financially protected if something happens to your pet. How Much Does.

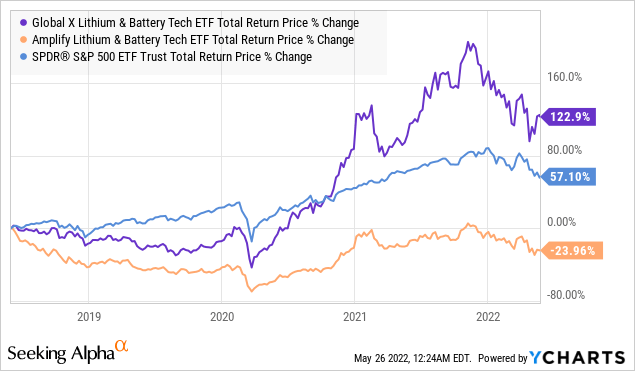

Global X Lithium & Battery Tech Etf Dividend

LIT Dividend Yield: % for Aug. 30, · Dividend Yield Chart · Historical Dividend Yield Data · Dividend Yield Definition · Dividend Yield Range, Past 5 Years. Global X Lithium & Battery Tech ETF (LIT) Dividends · Global X Lithium & Battery Tech ETF (LIT): $ · Get Rating · Component Grades. The Global X Lithium & Battery Tech ETF (LIT) invests in the full lithium cycle, from mining and refining the metal, through battery production. Global X Lithium & Battery Tech ETF is an exchange-traded fund incorporated in the USA. The Fund seeks investment results that correspond to the price and yield. Global X Lithium & Battery Tech ETF ; Domicile, United States ; Symbol, LIT ; Manager & start date. Nam To. 01 Mar Wayne Xie. 01 Mar Vanessa Yang. LIT tracks a market-cap-weighted index of companies involved in the global mining and exploration of lithium, or in lithium battery production. While the. LIT Dividend Information. Next Dividend: Dec Dividend Amount: - Increased Dividend: No. Forward Dividend Yield: %. LIT's Dividends. There are no upcoming dividend dates for Global X Battery Tech & Lithium ETF. Dividend History. Type, Final Dividend. Dividends of $ are expected for the next 12 months. This corresponds to a dividend yield of %. In which sector is Global X Lithium & Battery Tech ETF. LIT Dividend Yield: % for Aug. 30, · Dividend Yield Chart · Historical Dividend Yield Data · Dividend Yield Definition · Dividend Yield Range, Past 5 Years. Global X Lithium & Battery Tech ETF (LIT) Dividends · Global X Lithium & Battery Tech ETF (LIT): $ · Get Rating · Component Grades. The Global X Lithium & Battery Tech ETF (LIT) invests in the full lithium cycle, from mining and refining the metal, through battery production. Global X Lithium & Battery Tech ETF is an exchange-traded fund incorporated in the USA. The Fund seeks investment results that correspond to the price and yield. Global X Lithium & Battery Tech ETF ; Domicile, United States ; Symbol, LIT ; Manager & start date. Nam To. 01 Mar Wayne Xie. 01 Mar Vanessa Yang. LIT tracks a market-cap-weighted index of companies involved in the global mining and exploration of lithium, or in lithium battery production. While the. LIT Dividend Information. Next Dividend: Dec Dividend Amount: - Increased Dividend: No. Forward Dividend Yield: %. LIT's Dividends. There are no upcoming dividend dates for Global X Battery Tech & Lithium ETF. Dividend History. Type, Final Dividend. Dividends of $ are expected for the next 12 months. This corresponds to a dividend yield of %. In which sector is Global X Lithium & Battery Tech ETF.

Find the latest Global X Lithium & Battery Tech ETF (LIT) stock quote, history, news and other vital information to help you with your stock trading and. Global X Lithium & Battery Tech ETF has a trailing dividend yield of %, which is below the % category average. The fund normally distributes its. The share price of Global X Funds - Global X Lithium & Battery Tech ETF as of August 21, is $ / share. This is an increase of % from the prior. Global X Lithium & Battery Tech ETF (LIT) ; , , $ ; , , $ ; , , $ ; , The dividend is paid every six months and the last ex-dividend date was Jun 27, Dividend Yield. %. Annual Dividend. $ Ex-Dividend Date. Jun This ETF provides physical exposure, by owning its shares you earn the return of the securities composing the index (as the ETF holds them directly). Dividend. Global X Lithium & Battery Tech ETF LIT · NAV. · Open Price. · Bid / Ask / Spread. / / % · Volume / Avg. k / k · Day Range. Global X Lithium & Battery Tech ETF/Global X Funds Annual Stock Dividends ; , ; , ; , ; , Global X Lithium & Battery Tech UCITS ETF USD Acc currently pays no dividends. ISIN: IE00BLCHJN WKN. Key Stats · Expense Ratio % · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta- · YTD % Change · 1 Year % Change LIT (ETF). Global X Lithium & Battery Tech ETF. Payout Change. Pending. Price as of: AUG 30, PM EDT. $ + +%. primary theme. Natural Resources. LIT Dividends ; Dividend Yield (FWD). % ; Annual Payout (FWD). $ ; Payout Ratio. - ; 5 Year Growth Rate (CAGR). % ; Years of Growth. 0 Years. Global X Lithium & Battery Tech ETF (LIT) dividend growth history: By month or year, chart. Dividend history includes: Declare date, ex-div, record, pay. Dividend Data ; Dividend Yield. %. Sector Median % ; Annualized Payout. Paid Semi-Annual ; Payout Ratio. -. EPS - ; Growth Streak. 0 Years. Dividend Data ; Dividends per Share (TTM) ($), ; Dividend Yield %, LIT Dividend. This section compares the dividend yield of this ETF to its peers. LIT, ETF Database. LIT - Global X Lithium & Battery Tech ETF's top holdings are Albemarle Corporation (US:ALB), NAURA Technology Group Co., Ltd. (CN), TDK Corporation (DE. The Fund seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Lithium Index. Latest company dividends for Global X Battery Tech & Lithium ETF (ACDC) ; Financials, $, H F Result, $, % ; Financials, $, H F Result, $, %. Global X Battery Tech & Lithium ETF (ACDC) Upcoming Dividends & Yields ; HFResult, $, %, 28 Jun , ; HFResult, $, %, 30 Jun

Fico Points

Get your credit score at no charge! Discover Scorecard gives you your FICO® Score for Free with no harm to your credit. Learn more. Is this service impacting my credit/score? We already receive our cardholders' FICO® Scores from a credit bureau each month to help us manage your account. This. Your FICO Scores are calculated using five categories: payment history, amounts owed, new credit, length of credit history and credit mix. A FICO score is just one type of credit score. You actually have many credit scores across different credit bureaus and credit products. The base FICO® Scores range from to , and a good credit score is between and within that range. FICO creates. Your FICO® score will help lenders determine how trustworthy you are to repay debt. View your FICO Score with the help of Andrews Federal Credit Union. American Express MyCredit Guide is a free service that allows you to view your FICO Score and Experian credit report for free. A FICO® Score is a number, generally between , with representing the poorest FICO® Score and representing the strongest. A FICO score provides lenders with an indication of your ability to pay back debt. The higher your score, the less of a risk you represent to the lender and the. Get your credit score at no charge! Discover Scorecard gives you your FICO® Score for Free with no harm to your credit. Learn more. Is this service impacting my credit/score? We already receive our cardholders' FICO® Scores from a credit bureau each month to help us manage your account. This. Your FICO Scores are calculated using five categories: payment history, amounts owed, new credit, length of credit history and credit mix. A FICO score is just one type of credit score. You actually have many credit scores across different credit bureaus and credit products. The base FICO® Scores range from to , and a good credit score is between and within that range. FICO creates. Your FICO® score will help lenders determine how trustworthy you are to repay debt. View your FICO Score with the help of Andrews Federal Credit Union. American Express MyCredit Guide is a free service that allows you to view your FICO Score and Experian credit report for free. A FICO® Score is a number, generally between , with representing the poorest FICO® Score and representing the strongest. A FICO score provides lenders with an indication of your ability to pay back debt. The higher your score, the less of a risk you represent to the lender and the.

FNBO teamed up with FICO to give our customers free access to your FICO Score so you can better understand your financial wellbeing. In order to have access to your free FICO Score, you'll typically need to be the primary account holder on a consumer card. Once you meet the eligibility. A FICO score ranges from to and is used by lenders to assess borrowers' creditworthiness. Created by the Fair Isaac Corporation (FICO), the score. Your FICO Scores are calculated using five categories: payment history, amounts owed, new credit, length of credit history and credit mix. Get your FICO® Score for free in Online and Mobile Banking. Bank of America credit card customers: Log in to view your score or enroll in the program now. A FICO score provides lenders with an indication of your ability to pay back debt. The higher your score, the less of a risk you represent to the lender and the. If your credit score is in the to range, you could see an increase of 20 points or more under the new calculations, if you meet some of the other. In order to have access to your free FICO Score, you'll typically need to be the primary account holder on a consumer card. Once you meet the eligibility. A FICO 8 Score is the credit score used in the US. It is based on a range of , with being the highest possible rating and being the lowest. We offer FICO® Scores for free, for our primary cardholders. Your FICO® Score is calculated from the details in your credit report. With Credit Close-Up SM, you have free and easy access to your monthly credit update which includes: FICO® Score 9 from Experian. Simple access via Wells Fargo. FICO isn't your only credit score, but lenders widely use it, which means you should know your score and how it's determined. Your FICO score is based on your. Your FICO® Score. Fico Score. ELGA members with a loan or VISA credit card can view their FICO® Score in ELGA Credit Union Digital Banking! To access your score. Learn about the score that lenders use most. Vanderbilt Mortgage uses FICO^®^ Score to help customers understand their credit status which means better. Can You Raise Your Credit Score By Points in 30 Days? · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate. The FICO Score is a trademark of the Fair Isaac Corporation. It was the first widely used, commercially available score of its type. FICO Scores essentially. Based on your credit report, you get a credit score, the most common of which is called a FICO score, a three-digit number between and , which tells. Step 1 – Check with your bank or credit union. The first step you can take towards finding your FICO Score is by checking with your bank or credit union. Anywhere up to 7% is very healthy utilization that shouldn't hurt your credit score by more than two or three points. Paying off those last 7%. Understanding Your FICO® Score. FICO® Scores range between and For most lenders, anything above is considered good to very good, and should help to.

Heloc For Small Business

Home Equity Loan If you have a one-time borrowing need such as home improvement that requires a substantial lump sum payment upfront or for debt consolidation. Small business real estate loan · Apply for a specific loan amount up to $, · Choose the term of your loan. · Get up to 85% loan-to-value ratio. HELOCs are usually fixed closing costs that typically don't exceed a few hundred. Interest on a HELOC has been 4%-6% the last few years. In. A Lending Partner to Grow Your Business. WSFS has been helping small businesses in the region for nearly years. Icon of a house with a love. A HELOC also could be used in this manner, in that you could choose to immediately withdraw the full balance of the loan. Bear in mind that this could expose. You can use a HELOC to finance or refinance your home. Once your line of credit becomes available, you start accumulating credit as you pay back the principal. HELOC Benefits & Features · Already applied for a HELOC? · Other HELOC Options · Frequently Asked Questions · Residential Mortgages · Resources · Meet Your Expert. A home equity line of credit, or HELOC, is a second mortgage that lets you convert some of your equity in your home back into debt in exchange for cash. If you own a home, you may be eligible for a Home Equity Line of Credit (HELOC). A HELOC allows you to borrow funds against the equity in your home. It works. Home Equity Loan If you have a one-time borrowing need such as home improvement that requires a substantial lump sum payment upfront or for debt consolidation. Small business real estate loan · Apply for a specific loan amount up to $, · Choose the term of your loan. · Get up to 85% loan-to-value ratio. HELOCs are usually fixed closing costs that typically don't exceed a few hundred. Interest on a HELOC has been 4%-6% the last few years. In. A Lending Partner to Grow Your Business. WSFS has been helping small businesses in the region for nearly years. Icon of a house with a love. A HELOC also could be used in this manner, in that you could choose to immediately withdraw the full balance of the loan. Bear in mind that this could expose. You can use a HELOC to finance or refinance your home. Once your line of credit becomes available, you start accumulating credit as you pay back the principal. HELOC Benefits & Features · Already applied for a HELOC? · Other HELOC Options · Frequently Asked Questions · Residential Mortgages · Resources · Meet Your Expert. A home equity line of credit, or HELOC, is a second mortgage that lets you convert some of your equity in your home back into debt in exchange for cash. If you own a home, you may be eligible for a Home Equity Line of Credit (HELOC). A HELOC allows you to borrow funds against the equity in your home. It works.

A home equity line of credit, or HELOC, is a revolving credit line that's secured by the equity you've built in your home. The HELOC can be used as needed. Tax Liens & Mortgage Notes · Medium-Term Rentals · Buying & Selling Small Businesses · Outdoor Hospitality. Landlording & Rental Properties. General Landlording. Tap your home equity to finance your business ventures. Figure offers a fast and easy way to turn your home equity into cash, up to $k. Heloc is the cheapest institutional money you can get, and the terms are often the most favourable (interest only payments to stay in good. The main benefit to using home equity to start a business is that it can be a lot more accessible while also offering lower interest costs. Applying for a. When using a HELOC to fund a small business, your lender may ask for financial details on the company such as cash flow, tax returns and length of time in. It's a very bad idea. If the restaurant business fails, you still owe money to the bank, for both your mortgage, and the HELOC. If you refinance. A Home Equity Line of Credit (HELOC) is a convenient and cost-efficient way to borrow money for almost any purpose. As you pay down your mortgage, a Home Equity Line of Credit (HELOC) becomes a valuable loan option for you. Using the equity you've built in your home. equity, not just the amount of a smaller 2nd mortgage HELOC. This Small Business APP. Treasury Mgmt App. Also of Interest. Home Equity Loans in. Get your personalized rate for a Home Equity Line of Credit up to $K with Citizens FastLine, the simpler, faster way to get a HELOC. Many clients carry a small first mortgage or no mortgage on their home. You can use a HELOC to replace it, which allows access to your home's equity when you. Home Equity Line of Credit, is a secondary mortgage loan where you can lend for business purposes. The home equity loan rates are relatively cheaper than. A Servus HELOC is a financing solution specifically for homeowners that can help. With a HELOC you'll benefit from low interest rates and the flexibility to. It's a very bad idea. If the restaurant business fails, you still owe money to the bank, for both your mortgage, and the HELOC. If you refinance. If you want funds for your business and want to use your personal home as the collateral, this line of credit can provide you with access to funds immediately. A Home Equity Line of Credit (HELOC) is a convenient and cost-efficient way to borrow money for almost any purpose. Home improvements · Landscaping · Debt consolidation · Emergency cash availability · College expenses · Vehicle purchase · Medical expenses · Start-up business. Personal Small Business Wealth Management Businesses & Institutions About Key business days prior to the closing of the mortgage loan. This Interest. Home Equity Line of Credit, is a secondary mortgage loan where you can lend for business purposes. The home equity loan rates are relatively cheaper than.

Trupanion Maximum Payout

Unlimited payouts. Check icon Yes. No caps or limits on the amount Trupanion pays out. X icon One plan has a $10, limit, while the other uses a benefit. payout limits. You can also rest easy knowing your insurance premium won't increase as your pet ages and older pets can still be covered for hip dysplasia. Trupanion payouts work. With no limits, no deductibles, and a customizable payout percentage, we put the power in your hands. It's the one all the vet employees for their own pets at our clinic. They are also the largest, I worry about some of the smaller ones going. Like many of the top pet insurance services, it does not cover pre-existing conditions. The company's 90% reimbursement rate and no payout limit is just about. Pet health is always our priority · You'll never pay more just for using your coverage · Birthdays are for parties, not price increases · 99% of Trupanion members. 90% payout. No guesswork here — your coverage pays out at 90% for all eligible costs related to that condition for the rest of your pet's life. Trupanion · Benefits of Trupanion Insurance. ◦ No payout limits · One Simple Pet Insurance Plan. Despite just having one plan, Trupanion adjusts the premium. No-payout-limits. Enjoy unlimited payouts for life. No matter how often your pet needs treatment, you can rest easy knowing you have lifetime protection. Why. Unlimited payouts. Check icon Yes. No caps or limits on the amount Trupanion pays out. X icon One plan has a $10, limit, while the other uses a benefit. payout limits. You can also rest easy knowing your insurance premium won't increase as your pet ages and older pets can still be covered for hip dysplasia. Trupanion payouts work. With no limits, no deductibles, and a customizable payout percentage, we put the power in your hands. It's the one all the vet employees for their own pets at our clinic. They are also the largest, I worry about some of the smaller ones going. Like many of the top pet insurance services, it does not cover pre-existing conditions. The company's 90% reimbursement rate and no payout limit is just about. Pet health is always our priority · You'll never pay more just for using your coverage · Birthdays are for parties, not price increases · 99% of Trupanion members. 90% payout. No guesswork here — your coverage pays out at 90% for all eligible costs related to that condition for the rest of your pet's life. Trupanion · Benefits of Trupanion Insurance. ◦ No payout limits · One Simple Pet Insurance Plan. Despite just having one plan, Trupanion adjusts the premium. No-payout-limits. Enjoy unlimited payouts for life. No matter how often your pet needs treatment, you can rest easy knowing you have lifetime protection. Why.

maximum payout. Trupanion does not cover the exam fee for Maximum Payout Structure. Trupanion has an unlimited lifetime maximum payout structure. We pay our portion first so pet owners don't have to wait for a There's no annual, per condition, or lifetime payout limits. Trupanion doesn. My Trupanion quote had no cap of any kind on my payout — no per incident limit, no annual limit, and no lifetime limit. Trupanion doesn't cover your vet's basic. Payout limits may also be per year, or per condition. Most companies offer yoga-dlya-novichkov.ru *offers direct billing. yoga-dlya-novichkov.ru yoga-dlya-novichkov.ru Trupanion offers unlimited payouts with no sub limits. We are the only provider to have no payout limits, but also importantly no sub limits. payout limits. You can also rest easy knowing your insurance premium won't increase as your pet ages and older pets can still be covered for hip dysplasia. Currently, there are 5 main pet insurers that can pay the vet directly for you: Healthy Paws, Pets Best, Paw Protect, CarePlus by Chewy, and Trupanion. (view. Unlimited payouts. Check icon Yes. No caps or limits on the amount Trupanion pays out. X icon One plan has a $10, limit, while the other uses a benefit. Your maximum annual payout (also known as an annual coverage limit in insurance-speak) is the highest dollar amount you can be reimbursed for each year. Healthy Paws coverage has no maximum payout limits or annual caps. On average, Healthy Paws pet insurance costs $40 per month for dogs and $20 per month for. Several insurance providers, including Desjardins, OVMA, Spot, The Personal Pet Program and Trupanion offer unlimited payout options, which means there is no. There are annual and lifetime payout limits. The payout on eligible claims is always 90%. Exam fees are never covered. There are never any payout limits. Trupanion has paid out over $2 billion in veterinary invoices, including a single payout of more than $, (aspiration pneumonia in one English Bulldog). For the veterinary treatment your pet may need, Trupanion will pay 90% of the eligible bill with no payout limits. Trupanion can pay your pet's veterinary bills. Trupanion Insurance reimburses up to 90% of eligible costs after you have met your $0 to $1, deductible, with no lifetime payout limit. Their coverage. And unlike sparser plans, Trupanion has no payout limits! Does Trupanion have any dog breed restrictions? At Trupanion, we believe that all dogs — big. Trupanion. Offering lifetime coverage with no payout limits, Trupanion is known for its flexibility and customizable plans. Embrace Pet Insurance. Embrace. Payout Limits. Trupanion does not have payout limits, which is a truly great feature for people who have pets with lifelong illnesses. This includes no. We can pay our portion directly to your vet at the time of checkout, so there's no waiting on reimbursement. No-payout-limits. Enjoy unlimited payouts for life. Annual maximum payout may be set between $5, to $30, Embrace provides reimbursement rates of 70, 80 or 90 percent with deductible options of $, $

Becoming Your Own Financial Advisor

You can also try and get in to a financial advisor training program at a wirehouse like Merril or Morgan. They will usually pay you to get your. A financial advisor who is Authorized as an Infinite Banking Practitioner can help implement the process of becoming your own banker. This process when. Be Your Own Financial Adviser shows you how to make sensible financial decisions without the need for expensive advice. You should never feel that you need to make any financial decisions or commitments, or that you need to open an account, at your first meeting. Use the first. You don't have to hire a pro to manage your money, but to be your own financial advisor, you must have the inclination, time, and skills. A financial plan is a comprehensive approach to your financial future that you design with your Scotia advisor. Based on your personal aims, it gives you peace. Become Your Own Financial Advisor provides people of all ages and levels of wealth with practical information on how to improve their finances. If you want to become a financial planner, you'll need a mandatory license and optional degrees or certifications before getting a job in the field. Earn your. The best answer I've been able to come up so far is this: financial advisors who succeed have a plan. Benjamin Franklin once said, “If you fail to plan, you are. You can also try and get in to a financial advisor training program at a wirehouse like Merril or Morgan. They will usually pay you to get your. A financial advisor who is Authorized as an Infinite Banking Practitioner can help implement the process of becoming your own banker. This process when. Be Your Own Financial Adviser shows you how to make sensible financial decisions without the need for expensive advice. You should never feel that you need to make any financial decisions or commitments, or that you need to open an account, at your first meeting. Use the first. You don't have to hire a pro to manage your money, but to be your own financial advisor, you must have the inclination, time, and skills. A financial plan is a comprehensive approach to your financial future that you design with your Scotia advisor. Based on your personal aims, it gives you peace. Become Your Own Financial Advisor provides people of all ages and levels of wealth with practical information on how to improve their finances. If you want to become a financial planner, you'll need a mandatory license and optional degrees or certifications before getting a job in the field. Earn your. The best answer I've been able to come up so far is this: financial advisors who succeed have a plan. Benjamin Franklin once said, “If you fail to plan, you are.

As mentioned earlier, marketing is key to becoming a successful financial advisor. For your first few years in practice, people will not be coming to you. Personal Financial Specialist (PFS) – Have 75 hours personal financial planning education; also, hold a CPA, which requires a degree, plus 2 years experience. If you want to become a financial planner, you'll need a mandatory license and optional degrees or certifications before getting a job in the field. Earn your. Before you even begin approaching financial advisors, it's best to have a clear idea of your own financial goals and expectations, and the type of advice or. You can start on the path of becoming a financial advisor by obtaining a bachelor's degree, studying investment topics, and gaining relevant work experience. Covering a range of topics, including saving, investing, debt management and blunders to avoid, Become Your Own Financial Advisor provides people of all ages. A financial advisor is a term that applies to anyone who helps you manage money. That could include an employee of your bank. A financial planner is someone who. The CFP certification is a well-known badge of expertise in the industry. Earning it demands several years in financial planning, a formal degree, clearing the. Ask the planner – regardless of fee structure – if they have a professional obligation to put your interests ahead of their own. Financial planners with the. Become An Independent Financial Advisor · LICENSING · INSURANCE · INVESTMENT · EDUCATION & DEVELOPMENT. Work as a financial planner for a company targeting the employee benefits business. · Becoming a content creator and making your money through. As a financial advisor, you often have the flexibility to set your own schedule and work however is best for you. Also, you are in control of your earning. Become Your Own Financial Advisor provides people of all ages and levels of wealth with practical information on how to improve their finances. Success requires strong technical competence in all areas of financial planning, as well as a good working knowledge of estate planning, tax and family law. Providing Fee-Only, Advice-Only Financial Planning services to Canadians. Jason Heath, Nancy Grouni, Kim Allard. Markham Ontario. The starting costs of opening an independent financial advisory firm are substantial and need to be fully considered before going out on your own. Overhead. A personal experience that relates to your client's financial goals, or use a case study to illustrate how you helped a previous client achieve their objectives. If you're willing to handle certain aspects of your plan on your own: Obviously, the more work you're willing to do yourself, the more you should be able to. Work as a financial planner for a company targeting the employee benefits business. · Becoming a content creator and making your money through. ” She began her career in the financial services industry when she couldn't find a financial advisor to suit her own needs. Today she offers wealth.

Federal Prime Interest Rate Today

Bank Prime Loan Rate Changes: Historical Dates of Changes and Rates (PRIME) ; ; ; ; ; Updated interest rates on the prime lending rate. US Federal Funds Target Rate**, usd_fed_rate, usd_fed_rate_date. USD Scotiabank. target range for the fed funds rate at % - %. Therefore, the United States Prime Rate remains at % The next FOMC meeting and decision on short-term. That means that when the Fed raises interest rates, the prime rate also goes up. You can find the current prime rate on the Wall Street Journal website. Selected Interest Rates · 1-year, , , , · 2-year, , , , · 3-year. The prime rate is the interest rate that commercial banks charge creditworthy customers and is based on the Federal Reserve's federal funds overnight rate. The current Bank of America, N.A. prime rate is % (rate effective as of July 27, ). Graph and download economic data for Bank Prime Loan Rate (DPRIME) from to about prime, loans, interest rate, banks, interest. Historical Prime Rate ; · 7/27/, % ; · 12/16/, % ; · 6/29/, % ; · 2/3/, % ; · 11/15/ Bank Prime Loan Rate Changes: Historical Dates of Changes and Rates (PRIME) ; ; ; ; ; Updated interest rates on the prime lending rate. US Federal Funds Target Rate**, usd_fed_rate, usd_fed_rate_date. USD Scotiabank. target range for the fed funds rate at % - %. Therefore, the United States Prime Rate remains at % The next FOMC meeting and decision on short-term. That means that when the Fed raises interest rates, the prime rate also goes up. You can find the current prime rate on the Wall Street Journal website. Selected Interest Rates · 1-year, , , , · 2-year, , , , · 3-year. The prime rate is the interest rate that commercial banks charge creditworthy customers and is based on the Federal Reserve's federal funds overnight rate. The current Bank of America, N.A. prime rate is % (rate effective as of July 27, ). Graph and download economic data for Bank Prime Loan Rate (DPRIME) from to about prime, loans, interest rate, banks, interest. Historical Prime Rate ; · 7/27/, % ; · 12/16/, % ; · 6/29/, % ; · 2/3/, % ; · 11/15/

Selected Interest Rates · 1-year, , , , , · 2-year, , , , , · 3-year.

The prime rate helps financial institutions determine how much interest to charge their consumers. · Every six weeks, the Federal Reserve evaluates the economy. Instead, it depends on the Fed's responses to the economy and other factors. For example, the prime rate remained constant at % from March to March. It's worth noting, however, that TD is unique among these lenders in that they have their own prime mortgage rate, which is currently %. Institution, Prime. Current Prime Rate. Prime Rate Update · % – Effective as of: September 05, · What is Prime Rate? U.S. Government Rates ; Effective rate, , ; Target rate, , ; High, , target range for the fed funds rate at % - %. Therefore, the United States Prime Rate remains at % The next FOMC meeting and decision on short-term. Prime Rate Change Dates Since ; June 14, , ; March 22, , ; December 14, , ; June 15, , yoga-dlya-novichkov.ru provides the Wall Street Prime Rate and WSJ current prime rates index Wall Street Journal prime rate. Prime rate, federal funds rate, COFI. Bank Lending Rate in the United States remained unchanged at percent in June. This page provides - United States Average Monthly Prime Lending Rate. The industry median interest rate for most commercial real estate loans usually falls approximately 3% above the effective federal funds rate. The current prime. The current prime rate among major U.S. banks is %. The prime rate normally runs three percentage points above the central bank's federal funds rate, which. The current prime rate is %. It last changed on July 27, Data source: Wall Street Journal (print edition). Current and Historical Data. What is the current prime rate? The prime rate is % as of July , according to the Fed. This is the lowest rate in the past year and since How is. Prime Rate History target range for the fed funds rate at % - %. interest rates will be on September 18, New York City Rent Is Too High! Financial institutions and large lenders will base their interest rates on the prime rate, generally establishing their current rates at an amount that is. US Bank Prime Loan Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. Historical data for the WSJ prime rate · Date of Change · (% - %) · - (%) · (% - %) · (% - %) · (% -. Today, the cost of shelter is the single biggest U.S. Fed policy makers leaning strongly toward September interest rate cut, meeting minutes show. Prime Rate History target range for the fed funds rate at % - %. interest rates will be on September 18, New York City Rent Is Too High! So, if the federal funds rate is 4%, lenders may set prime at 7%. Your APR would be determined from there. The interest terms you get on a loan or credit card.

How To Choose The Best Brokerage Account For You

IRAs have the most tax benefits because you don't have to pay any taxes when you withdraw money. You can use these savings accounts to play the stock market and. It's just as crucial to pick a broker as it is to pick your investment assets. Your investment style, the amount of flexibility you have with your. A lot of those brokerage accounts have good resources available to you as well, so do some research as to which might be the best for you. Wondering how to invest money? Well, if you want to create a stock portfolio and invest in exchange-traded funds or some other investments with the. Customer service: Do you have a question about your account or about making a trade? When you do, you'll need to reach the broker and ask it. The levels of. How your own investment style, financial plan and risk tolerance impact your decision on where to open your account. Matching investment brokerage features with. Want to buy stocks? To buy and sell investments like stocks (as well as ETFs, mutual funds, and others), you'll need an account with a stock broker. When opening a brokerage account, investors have two main options: a cash account or a margin account. The difference between them is how and when you pay for. Each year, I try to take a look at brokerage accounts, bank accounts, and credit card accounts to see if there is a better option I could be. IRAs have the most tax benefits because you don't have to pay any taxes when you withdraw money. You can use these savings accounts to play the stock market and. It's just as crucial to pick a broker as it is to pick your investment assets. Your investment style, the amount of flexibility you have with your. A lot of those brokerage accounts have good resources available to you as well, so do some research as to which might be the best for you. Wondering how to invest money? Well, if you want to create a stock portfolio and invest in exchange-traded funds or some other investments with the. Customer service: Do you have a question about your account or about making a trade? When you do, you'll need to reach the broker and ask it. The levels of. How your own investment style, financial plan and risk tolerance impact your decision on where to open your account. Matching investment brokerage features with. Want to buy stocks? To buy and sell investments like stocks (as well as ETFs, mutual funds, and others), you'll need an account with a stock broker. When opening a brokerage account, investors have two main options: a cash account or a margin account. The difference between them is how and when you pay for. Each year, I try to take a look at brokerage accounts, bank accounts, and credit card accounts to see if there is a better option I could be.

One of the best ways to safeguard your investment is to understand what your account executive is doing in your account. The first way to accomplish this is to. Think carefully about whether all the extras a stock broker promises are really worth much to you. You may be better off with you'd be better off with a simpler. 24/7 live customer support is the gold standard. Look out for support via email and live chat as well. Brokerage Account Opening. Once you choose a brokerage. When you open a brokerage account, you need to choose between an individual or joint brokerage account. Whichever option works best for you, Schwab has. A lot of those brokerage accounts have good resources available to you as well, so do some research as to which might be the best for you. Authorization: You may be able to authorize somebody else (a spouse, for instance) to make decisions for your account—you may need to provide written legal. 1. Choose the type of investment account you want. Identifying the right brokerage account for you will depend largely on your financial objectives. When you open a brokerage account, you need to choose between an individual or joint brokerage account. Whichever option works best for you, Schwab has. Security and protection should be top priorities for any beginner opening a new brokerage account. You'll want to make sure your personal. When placing your money with a broker, you need to make sure your Choose the Best Account Type for You. Individual Accounts. Customer service and support are critical when it comes to choosing a brokerage firm. Look for a firm that offers responsive and knowledgeable. Deposit funds - once you've opened a brokerage account, you can start depositing funds. · Pick a market to trade in - think of your online brokerage account as. 1. Choose the type of investment account you want. Identifying the right brokerage account for you will depend largely on your financial objectives. If the idea of picking your own stocks is overwhelming, you can opt to work with a financial advisor. These are individuals who act as brokers and are paid on. Some trading platforms provide a more general investment approach. Others build niches to focus on options trading or more advanced investing. You should choose. determination of what will best meet your investment Call our office for a copy of the booklet Understanding. Your Brokerage Account Statements. Before choosing an online broker with our comparison tool, the first step is to determine which type of investor you are. In the left-side sidebar, you can. Other items to consider are minimum account balances and maintenance fees. Better Investing investment clubs should focus long-term investing and resist the. You might want a brokerage account that is easily accessible for regular checks on the performance of your portfolio. Or, you might want a brokerage account. Some trading platforms provide a more general investment approach. Others build niches to focus on options trading or more advanced investing. You should choose.

Programs For Working Out

2. Design your fitness program · Think about your fitness goals. · Make a balanced routine. · Start slow and go forward slowly. · Build activity into your daily. Best digital home or gym training experience ⚡ Shred app provides a dynamic, personalized training experience ⚡ Workouts app on iOS or Android. Check out Sydney Cummings on YouTube! She was my go to before I started working with a personal trainer. This portion should last around seven minutes. When you are done with this circuit, let your client rest 30 seconds and move on to resistance training. Read. Largest range of FREE workout routines available! Muscle building, fat loss, strength, abs, women's, fitness and more. Like the other workout programs on this list, 5/3/1 centers on a handful of compound exercises, which you complement with accessory work to target weaker areas. Aerobic. The core of any fitness program should include some form of continuous movement. · Strength. These exercises help increase muscle power and strength. Exercise Types to Include in a Beginner Workout Plan · Squats · Lunges · Push-ups · Pull-ups · Planks · Crunches · Leg raises. Exercise programs are popular. There are gyms and other fitness providers with many different types of classes, exercise routines and equipment. 2. Design your fitness program · Think about your fitness goals. · Make a balanced routine. · Start slow and go forward slowly. · Build activity into your daily. Best digital home or gym training experience ⚡ Shred app provides a dynamic, personalized training experience ⚡ Workouts app on iOS or Android. Check out Sydney Cummings on YouTube! She was my go to before I started working with a personal trainer. This portion should last around seven minutes. When you are done with this circuit, let your client rest 30 seconds and move on to resistance training. Read. Largest range of FREE workout routines available! Muscle building, fat loss, strength, abs, women's, fitness and more. Like the other workout programs on this list, 5/3/1 centers on a handful of compound exercises, which you complement with accessory work to target weaker areas. Aerobic. The core of any fitness program should include some form of continuous movement. · Strength. These exercises help increase muscle power and strength. Exercise Types to Include in a Beginner Workout Plan · Squats · Lunges · Push-ups · Pull-ups · Planks · Crunches · Leg raises. Exercise programs are popular. There are gyms and other fitness providers with many different types of classes, exercise routines and equipment.

8fit · Aaptiv · Apple Fitness+ · Blogilates · Centr, by Chris Hemsworth · Find What Feels Good · FitOn: Fitness Workout Plans · Jefit. And how does it work? · Sign up. It's % free and always will be. · Join our fitness programme. Take part from the comfort of home at your own pace. · Get fit! Functional training is a type of training that focuses on movements that help you function better in your everyday life. A fitness app designed for you Access fitness programs on the go, track and schedule activities, find locations, and get your member ID with SilverSneakers GO. Get the BODi app (formerly Beachbody) and meet your goals. You've tried working out before; BODi keeps you engaged in ways that work for you. Whether you're just starting out―or starting again―this fast-track workout plan will help you drastically improve your physique and fitness levels. You don't need a gym membership to get the results you want. At-home workouts are a great option if you're limited with equipment, short on time, or just on the. Stay consistent in your fitness journey with collections of cardio or resistance workout programs to help you lose weight or gain strength and muscle from. Functional training is a type of exercise that aims to improve daily function outside the gym. Because of this, functional training involves exercises that. Before you begin exercising, dedicating time to a dynamic warm-up is pivotal, especially when you're a beginner at the gym. Begin with a brisk 5-minute walk. 1-week sample exercise program · Monday: minute moderate-pace jog or brisk walk. · Tuesday: Rest day. · Wednesday: Walk briskly for 10 minutes. · Thursday: Rest. Get training tips, exercise advice, and workout routines from the professionals at Muscle & Fitness and start building muscles to transform your body today! + FREE workouts, fitness programs, monthly challenges and training guides. Free home workout plans for all fitness levels! From beginner workout plans to advanced HIIT and functional strength training workout programs. Fitness Blender provides free full length workout videos, workout routines, healthy recipes and more. EGYM Training Programs provide customers with scientifically sound and automatically updated workout routines. Programs. malibu-circle. Join live classes. Your browser does not on your workout and help you compete with others working out with you. You. Fitness Blender provides free full length workout videos, workout routines, healthy recipes and more. And how does it work? · Sign up. It's % free and always will be. · Join our fitness programme. Take part from the comfort of home at your own pace. · Get fit! Workout programs that put you first. · Training designed for any day of the week. · Training designed for any day of the week. · Keep it moving. · Work out your way.