yoga-dlya-novichkov.ru Community

Community

Jcpenney Credit Card Apply Online

From general purpose Synchrony Mastercards to store cards from brands you love best, find the credit card that works best for you. Apply online today. 22 votes, 66 comments. I'm 19 and only have a debit card, not credit. I swear when I was checking out a JCPenney's she said rewards card. How do I apply for a JCPeney Credit Card? It's easy to apply for a JCPenney Credit Card Online and it only takes a couple of minutes to complete the process. Pay your JCPenney Credit Card bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple, protected way. By providing your social security number, Synchrony will attempt to find your information to expedite your request. Credit Card or JCPenney Mastercard® account. For each $1 spent on a Rewards apply to net card purchases (minus returns). Once you reach points. Can I request a replacement card online? Yes. After you log-in, select replacement card from the e-Service menu. The card will be sent to the address on record. Save More and Earn Rewards · Be the first to know about the latest deals and more! Sign Up · *Text Alerts: Message and data rates may apply. See Details. You may use your Card to make. Purchases on credit from time to time under your Account, up to any credit limit we may establish for your Account (your "Credit. From general purpose Synchrony Mastercards to store cards from brands you love best, find the credit card that works best for you. Apply online today. 22 votes, 66 comments. I'm 19 and only have a debit card, not credit. I swear when I was checking out a JCPenney's she said rewards card. How do I apply for a JCPeney Credit Card? It's easy to apply for a JCPenney Credit Card Online and it only takes a couple of minutes to complete the process. Pay your JCPenney Credit Card bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple, protected way. By providing your social security number, Synchrony will attempt to find your information to expedite your request. Credit Card or JCPenney Mastercard® account. For each $1 spent on a Rewards apply to net card purchases (minus returns). Once you reach points. Can I request a replacement card online? Yes. After you log-in, select replacement card from the e-Service menu. The card will be sent to the address on record. Save More and Earn Rewards · Be the first to know about the latest deals and more! Sign Up · *Text Alerts: Message and data rates may apply. See Details. You may use your Card to make. Purchases on credit from time to time under your Account, up to any credit limit we may establish for your Account (your "Credit.

JCPenney credit offer. Click Tap for Details. Tap for details.

Apply in-store at any register or online. Is there a specific credit score I Fair credit or better, or a score of or more, is the baseline for a JCPenney. See an associate in store to apply, click here to apply online, or apply from the JCPenney mobile app. Why do I need to link my JCPenney Credit Card to. 1- Be at least 18 years old. 2- Be a legal resident of the US or Canada. 3- Have either no credit history, or good (preferred) credit history. How do I get a JCPenney card? You can apply in store or online by visiting our credit card application page. See if you prequalify with no impact to your credit bureau score. CHECK OUT OUR APP! GET ALL YOUR REWARDS & COUPONS DELIVERED TO YOU, RIGHT IN THE WALLET. How do I apply for a JCPeney Credit Card? It's easy to apply for a JCPenney Credit Card Online and it only takes a couple of minutes to complete the process. How to apply for JCPenney credit card · Visit the JCPenney credit card website. · Fill in the application form. You will typically need to provide general. View & pay bill. Plcc banner. Earn Rewards Faster. JCPenney Credit Card -View Details *Text Alerts: Message and data rates may apply. See Details. Privacy. This Amended and Restated Credit Card Program Agreement (“Agreement”) is made as of October 5, (the “Effective Date”) by and between J. C. PENNEY. The JCPenney Credit Card, issued by Synchrony Bank, could be a compelling option for fans of department store credit cards. Here's what to know before you apply. Get all the details of JCPenney Credit Card including APR, annual fee, reward points, so you can apply for the right card today. Don't Have a JCPenney Credit Card? Apply Now. Contact your local store for additional promotional financing offers that may be available. Welcome to the JCPenney Commercial Account Application operated by Synchrony Bank. This is a secure online application. Your security is important to us and. Card and the JCPenney Privilege Platinum Card. save 10%. * Offer for new accounts. Subject to credit approval. Some restrictions and exclusions apply. Find the best online shopping deals, rewards and coupons on your phone - it's easy! Find exclusive discounts and shop women's clothes, shoes, home and much. Home · Apply now · My account · Pay my bill · JCPenney Rewards · Card benefits · Gold & Platinum status · FAQs · Contact us | Privacy Policy | Web Site. purchases of $99+. See terms. Apply nowApply now for PayPal Credit financing. Earn up to 5x points when you use your eBay Mastercard®. Learn more. Coupon can be combined with earned JCPenney Rewards and JCPenney Credit Card new account in-store discount. Coupon cannot be used for payment on account. How to apply for the JCPenney Card. You can apply for a JCPenney Credit Card both online and in person at your local store. To apply online, go to JCPenney's. JCPenney Credit Card Customer Service phone line at 1 () This number is also valid for JCPenney credit card online payment, those who apply for.

How To Calculate How Much Tax You Owe Self Employed

The “self-employment tax” means you'll pay up to % for Social Security and Medicare taxes, since you're considered as both employer and employee. tax can be tricky. With our employed and self-employed tax calculator, you can very quickly find out how much income tax and national insurance you could. This is calculated by taking your total 'net farm income or loss' and 'net business income or loss' and multiplying it by %. This is done to adjust your. Answer a few questions, and our tax calculator will estimate your refund or the amount you might owe the IRS. Quickly calculate how much Income Tax and National Insurance you owe on your earnings if you're both employed and self-employed. The self-employment tax deduction allows you to deduct the employer portion of your self-employment tax when calculating your adjusted gross income, which is. (You use this percentage since employees pay half of Social Security and Medicare taxes or % of their total wage income.) 3. Calculate the Social Security. How would you like to save money, annually, by simply claiming back business-related expenses on your income tax return? We sure think it sounds good! As a earner, you'll have to deal with self-employment tax, which is basically just how you pay FICA taxes. The combined tax rate is %. Normally, the. The “self-employment tax” means you'll pay up to % for Social Security and Medicare taxes, since you're considered as both employer and employee. tax can be tricky. With our employed and self-employed tax calculator, you can very quickly find out how much income tax and national insurance you could. This is calculated by taking your total 'net farm income or loss' and 'net business income or loss' and multiplying it by %. This is done to adjust your. Answer a few questions, and our tax calculator will estimate your refund or the amount you might owe the IRS. Quickly calculate how much Income Tax and National Insurance you owe on your earnings if you're both employed and self-employed. The self-employment tax deduction allows you to deduct the employer portion of your self-employment tax when calculating your adjusted gross income, which is. (You use this percentage since employees pay half of Social Security and Medicare taxes or % of their total wage income.) 3. Calculate the Social Security. How would you like to save money, annually, by simply claiming back business-related expenses on your income tax return? We sure think it sounds good! As a earner, you'll have to deal with self-employment tax, which is basically just how you pay FICA taxes. The combined tax rate is %. Normally, the.

Self employment taxes are comprised of two parts: Social Security and Medicare. You will pay percent and your employer will pay Social Security taxes of Enter your estimated weekly or monthly profit to get an idea of how much Income Tax and Class 4 National Insurance you'll pay. The estimate you get will be. If you are self-employed, you will need to report your net earnings to Social Security and the Internal Revenue Service (IRS). Net earnings for Social. Estimate Your Income Tax and Pay the Tax Each Quarter If For example, if you are self-employed, you should pay estimated income tax, or if you receive a. Estimate your self-employed taxes easily with our free calculator. Input your income, expenses, and instantly get your result. Then, multiply the result by % to calculate what you owe for self-employment. Calculate Your Estimate. You've calculated your estimated income, taken. Save on self employment tax by switching from a sole proprietorship to an S corp. Use our tax calculator to see how much you could be saving. Self-employment income (include bus. income/loss from rentals), For how many infirm children under 18 are you claiming the Family/Canada Caregiver. If the result is less than $, you do not owe any self-employment tax on this income. If the result is greater than $ you owe self-employment taxes. If you expect to owe self-employment income), then you are required to pay estimated taxes. This simple calculator can help you figure out how much you may. This means that you'll multiply your net earnings by to arrive at the amount of self-employment tax you need to pay. For example, if your net earnings. tax can be tricky. With our employed and self-employed tax calculator, you can very quickly find out how much income tax and national insurance you could. Get a rough estimate of how much you'll get back or what you'll owe. Do it yourself with our tax software. A simple way to file taxes online. We'll be. Most self-employed individuals end up in the % income tax range, with most people having an average (or “effective”) tax rate of around 14%. (You can read. The total of Self-employment tax is always your net profit multiplied by (%), which is then multiplied by (%) and that number split in half. Remember. If you're self-employed, the self-employed tax calculator can help you estimate your Self Assessment tax bill. estimate how much Income Tax you should pay for. One-half of self-employment tax; Qualified tuition expenses; Tuition and fees The AMT affects many in higher tax brackets since it eliminates many of the. This calculator computes federal income taxes, state income taxes, social security taxes, medicare taxes, self-employment tax, capital gains tax, and the net. Unique self-employed income calculator to work out what you need to pay towards your income tax, National Insurance & take home pay. StepChange. How much money do I owe for quarterly taxes? When do I need to pay my quarterly taxes? Hurdlr helps you answer these questions. Tracking Your Mileage With.

Byte Invisalign Cost

Comparing the Best Mail-Order Aligners in ; Cost, $2, + $95 (impression kit), Varies per patient (hypothetical cost provided on website is $3,). Invisalign is also more expensive than Byte, with Invisalign treatments costing up to $8, whereas Byte treatments cost up to $2, No matter which. By contrast, treatment with at-home aligners like Byte costs $2, Some people also appreciate the opportunity to stay away from a crowded, loud office filled. Invisalign is also more expensive than Byte, with Invisalign treatments costing up to $8, whereas Byte treatments cost up to $2, No matter which. Option 1: Re-entry Fee: The cost is $ This reinstates your Aligner Guarantee This lets us send you a new impression kit to get a new treatment plan created. Comparing Invisalign and Byte involves considering the cost. Invisalign usually has a higher price point, depending on the complexity of the case and location. *Total price includes purchase of All-Day Aligners and establishment fee for $2, and $8 monthly admin fee ($ total). Lending criteria and T&Cs apply. You begin with the Byte Impression Kit, which is $ This cost is risk-free and fully refundable if your dentist or orthodontist determines that you're not a. Byte vs. Smileie: Byte and Smilieie are the most similar in the service and products they offer. However, Smileie offers more affordable pricing for their clear. Comparing the Best Mail-Order Aligners in ; Cost, $2, + $95 (impression kit), Varies per patient (hypothetical cost provided on website is $3,). Invisalign is also more expensive than Byte, with Invisalign treatments costing up to $8, whereas Byte treatments cost up to $2, No matter which. By contrast, treatment with at-home aligners like Byte costs $2, Some people also appreciate the opportunity to stay away from a crowded, loud office filled. Invisalign is also more expensive than Byte, with Invisalign treatments costing up to $8, whereas Byte treatments cost up to $2, No matter which. Option 1: Re-entry Fee: The cost is $ This reinstates your Aligner Guarantee This lets us send you a new impression kit to get a new treatment plan created. Comparing Invisalign and Byte involves considering the cost. Invisalign usually has a higher price point, depending on the complexity of the case and location. *Total price includes purchase of All-Day Aligners and establishment fee for $2, and $8 monthly admin fee ($ total). Lending criteria and T&Cs apply. You begin with the Byte Impression Kit, which is $ This cost is risk-free and fully refundable if your dentist or orthodontist determines that you're not a. Byte vs. Smileie: Byte and Smilieie are the most similar in the service and products they offer. However, Smileie offers more affordable pricing for their clear.

It would cost $ byte vs. $ invisalign through my orthodontist. I keep reading horror stories on Byte so I am almost inclined to go through my ortho. Invisalign is more expensive due to the personalized service and complexity of the cases it can address. Byte's streamlined, remote model could be cheaper but. How Much Does Invisalign Cost? Generally, the cost of Invisalign treatment can range from $3, to $8,, with the average being about $5, However, prices. An Invisalign treatment will set you back by about $ Byte aligners cost an average of $1, There's also the fact that Byte claims quicker results than. Pricing as per Orthodontics Australia, comparing Byte's average Aligner Cost cost of traditional braces at $7, and other invisible braces at $8, Before you even get started with Byte, you'll have to pay $95 for an impression kit. Then, your full set of aligners will set you back $1, That's about. DID YOU KNOW Byte aligners may be covered by your insurance–but cost as little as $89 a month even without coverage. Byte night aligners allow you to. Compare Invisalign & Byte aligners at Smile Savers Dentistry. Get expert guidance & book a consultation in Columbia, MD: () Byte aligners, we'll help get it back at no additional cost.³. HyperByte. Fast Byte Retainers are currently only available with Byte aligner. Table of Contents ; Ceramic braces, $6, ; Lingual braces, $9, ; Invisalign, $4, ; Byte, $2, cost of going to the ortho. Reply reply. Share. freshwazhere. • Invisalign treatment with elastics. Reply reply. Share. Astroglaid • 4y. Invisalign's pricing is more difficult and depends on the customer's situation. However, Invisalign is much more expensive than most invisible braces providers. The cost of invisible aligners varies depending on brand and treatment type, but prices typically range between $$ While some brands like Invisalign. Convenience: Byte's treatment is virtually entirely remote. · Speed: Byte promises quicker results than braces or other brands of clear aligners. · Cost. How Much Do Byte Invisible Braces Cost? ; One-time payment up front, $2,, $2, ; Impression Kit, $95, $95 ; HyperByte, Free, Free ; BrightByte (1-month supply). Affordability: Byte often offers a lower upfront cost compared to Invisalign, making it an attractive option for budget-conscious patients. Invisalign vs. Starting price: $2, ; Treatment duration: 43 months** ; At-home fitting: Yes ; Accepts insurance: Yes ; Money back guarantee: Only covers initial $95 impression. Comments · The BRUTAL TRUTH about Invisalign · Final results w/ Byte at-Night for crooked teeth! · Clear Braces Vs Invisalign | The Winner Is. ⁵The average price of Invisalign is about $5, ⁶Average price displayed is based on Byte All-Day Clear Aligners, $, Byte At-Night Clear Aligners, $

Price Of Bed Sheet

Roseford Cotton Percale White and Soft Orange Sheet Set · $ $ · Harperette Cotton Percale Pink and Blue Sheet Set. Shop bed sheets at Lands' End. FREE shipping available. Find quality bedding sheets, white sheets, cotton bed sheets, bed linens, sheet sets, and more. ULLVIDE Fitted sheet, Full/Double. $Price $ Spend $ on comfort sleep items, get 15% off. Price valid from Aug 8, until Sep 10, Sheet Collection are setting a new standard for low-cost hospitality bed linens. The Ultra Touch 90 GSM Microfiber Fitted Sheets provide. Price Low - High, Price High - Low, Customer Rating, New Arrivals. Thread Count Cotton Deep Pocket Luxury Hotel Stripe Sheet Set. +. King Size Bed Sheet Sets ; Superior Egyptian Cotton Thread Count Eco-Friendly Solid Sheet Set · From $ Comparison Price $ Bedsure Breescape™ Cooling Sheet Set. From $ · Bedsure Satin Sheet Set. Quick add. Bedsure Satin Sheet Set. Bed Sheets and Pillowcases ; Beautyrest Thread Count Cotton Blend Cooling 4 PC Sheet Set · 24 options. From $ Comparison Price. I Sleep Shop Natural Bamboo Sheet Set. 5 out of 5 Customer Rating. No Reviews. From. Price reduced from $ to Save 31% $ Delivery by Aug Roseford Cotton Percale White and Soft Orange Sheet Set · $ $ · Harperette Cotton Percale Pink and Blue Sheet Set. Shop bed sheets at Lands' End. FREE shipping available. Find quality bedding sheets, white sheets, cotton bed sheets, bed linens, sheet sets, and more. ULLVIDE Fitted sheet, Full/Double. $Price $ Spend $ on comfort sleep items, get 15% off. Price valid from Aug 8, until Sep 10, Sheet Collection are setting a new standard for low-cost hospitality bed linens. The Ultra Touch 90 GSM Microfiber Fitted Sheets provide. Price Low - High, Price High - Low, Customer Rating, New Arrivals. Thread Count Cotton Deep Pocket Luxury Hotel Stripe Sheet Set. +. King Size Bed Sheet Sets ; Superior Egyptian Cotton Thread Count Eco-Friendly Solid Sheet Set · From $ Comparison Price $ Bedsure Breescape™ Cooling Sheet Set. From $ · Bedsure Satin Sheet Set. Quick add. Bedsure Satin Sheet Set. Bed Sheets and Pillowcases ; Beautyrest Thread Count Cotton Blend Cooling 4 PC Sheet Set · 24 options. From $ Comparison Price. I Sleep Shop Natural Bamboo Sheet Set. 5 out of 5 Customer Rating. No Reviews. From. Price reduced from $ to Save 31% $ Delivery by Aug

Percale: ; Percale Sheet Set · Sale Price: $ · 6 sizes · Gray ; Percale Duvet Cover · Price: $ 2 sizes · Gray ; Percale Pillowcase Set · Price: $ 2 sizes. Elevate your sleep with premium wholesale bed sheets in Elizabeth, NJ. Unparalleled quality, unbeatable prices. Free shipping on pallet yoga-dlya-novichkov.rut Now. Don't Miss the Best Deals on Bed Sheet Sets, Deep Pockets, Bamboo, Flannel Sheets & More. Shop Now From 30+Colors All Sizes Available. Sheets (59 items) (59 items). Find quality bedding at affordable prices when you shop for bulk sheets at DollarDays. 7 sizes · (,). 20K+ bought in past month. $ · 29 ; 13 sizes · (,). 20K+ bought in past month. $ · 19 ; 5 sizes · (,). 4K+ bought in past. Our fitted sheets are made with extra wide ribbed elastic in each corner, which helps keep the sheet snug on the mattress all night long. This prevents the. 12 Products. Manual. Featured; Best selling; Oldest to Newest; Price Low to High; Price High to Low; Manual; Newest to Oldest. Percale Sheet Set. sale. Percale. Our thread count egyptian comfort sheets are some of the finest bed sheets on the market. Check out our low prices and free shipping today. Queen King 20"W x 30"L Cal-King King Pillowcase Standard Pillowcase Twin/Twin XL. Price. $. $. Submit. Clear all · +12 · Thread Count Sheet Set by Martex. Shop Target for Sheets & Pillowcases you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup. Free standard shipping with. Regular price $ Sale pricefrom $ Sale. 3 Piece Fitted Bed Sheet Set With Durable Elastic And 2 Pillowcases % Egyptian Cotton Thread Count -. Shop Target for Sheets & Pillowcases you will love at great low prices bare home sheets reviews · detachable bed skirt · pillowfort ladybug sheets · sheets. Bed Sheets ; Kirkland Signature Thread Count Sheet Set. Bed Sheets ; Kirkland Signature Thread Count Sheet Set. Complete your bed with new sheets and pillowcases to help regulate temperature and comfort. Mattress Firm has bed sheet sets from top brands at great deals. Price. to. Delivery method. All. Local pickup White & Green Bed Sheets (Fitted Sheet, Thin Sheet, & 2 Standard Pillowcases. $10$ White & Green Bed Sheets. Soprano Sateen Sheet Set · $ - $ · $ - $ ; Boutique Percale Sheet Set · $ - $ · $ - $ ; Emily Egyptian Cotton Sheet. Choose matching bed sheets or mix and match coordinating separates from our collections and create a restful, comfortable retreat. Categories. Bed Sheets & Pillowcases Mattress Pads & Toppers Pillows price: low to high, Sort by price: high to low. PureCare Modal.

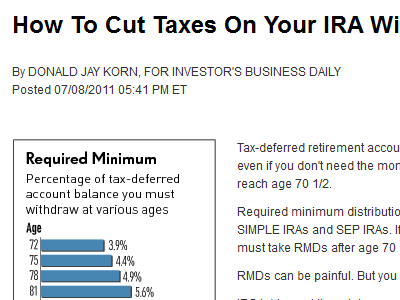

What Is The Tax Rate On Ira Withdrawals After Retirement

Contributions: Because your Roth IRA contributions are made with after-tax dollars, you can withdraw your regular contributions (not the earnings) at any time. As a resident of Delaware, the amount of your pension and K income that is taxable for federal purposes is also taxable in Delaware. However, person's $25 will be paid in taxes and the remaining $75 contributed to the Roth IRA. At retirement, the distributions will be tax-free. Illinois does not tax the amount of any federally taxed portion (not the gross amount) included in your Form IL, Line 1, that you received from. The U.S. government charges a 10% penalty on early withdrawals from a Traditional IRA, and a state tax penalty may also apply. You can learn more at IRS. Therefore, your distributions are usually taxable. A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account. With a traditional IRA, withdrawals are subject to ordinary income tax. Therefore, if the taxpayer takes a $10, distribution for a down payment on a first. The tax rate for your (k) distributions will depend on which federal tax bracket you are in at the time of withdrawal. You have to pay taxes on the money you. Once you start taking out income from a traditional IRA, you owe tax on the earnings portion of those withdrawals at your regular income tax rate. If you. Contributions: Because your Roth IRA contributions are made with after-tax dollars, you can withdraw your regular contributions (not the earnings) at any time. As a resident of Delaware, the amount of your pension and K income that is taxable for federal purposes is also taxable in Delaware. However, person's $25 will be paid in taxes and the remaining $75 contributed to the Roth IRA. At retirement, the distributions will be tax-free. Illinois does not tax the amount of any federally taxed portion (not the gross amount) included in your Form IL, Line 1, that you received from. The U.S. government charges a 10% penalty on early withdrawals from a Traditional IRA, and a state tax penalty may also apply. You can learn more at IRS. Therefore, your distributions are usually taxable. A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account. With a traditional IRA, withdrawals are subject to ordinary income tax. Therefore, if the taxpayer takes a $10, distribution for a down payment on a first. The tax rate for your (k) distributions will depend on which federal tax bracket you are in at the time of withdrawal. You have to pay taxes on the money you. Once you start taking out income from a traditional IRA, you owe tax on the earnings portion of those withdrawals at your regular income tax rate. If you.

Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. IRA distributions · Traditional IRAs – contributions are considered pre-tax, and all distributions are subject to tax at your ordinary income tax rate. · Roth. "A Roth IRA or Roth (k) can help you save on taxes in retirement. Not only are withdrawals potentially tax-free,2 they won't impact the taxation of your. Tax Penalties for Early Withdrawals You can easily calculate penalties for early withdrawals on IRAs. Just multiply the taxable distribution amount by 10%. Retirement tax rates by income source Roth IRA or Roth (k) qualified distributions are tax-free. Social Security income is taxed at your ordinary income. How Traditional IRA Withdrawals Are Taxed · In , for married couples filing jointly the 22% bracket went from taxable income of $89, to $, · In. Division VI of that legislation excludes retirement income from Iowa taxable income for eligible taxpayers for tax years beginning on or after January 1, Withdrawals from traditional IRAs are taxed as regular income, based on your tax bracket for the year in which you make the withdrawal. NEXT: Where should I. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. An IRA rollover can maintain the tax deferral. Ultimately, those pretax dollars will be withdrawn and reported as taxable income. If you are retired then, in a. More In Retirement Plans Generally, the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called "early" or ". Income on assets held in an IRA is not taxable. • Distributions can be considered income for. PA personal income tax purposes to the extent distributions exceed. In general, an early traditional IRA withdrawal amount will be included in your gross income tax as taxable income for the year. The withdrawals are not. In most cases, IRA cash distributions are subject to a default 10% federal withholding rate. However, the 10% rate may not be suitable for your tax situation. tax-advantaged retirement accounts (excluding Roth IRAs, and Roth accounts in employer retirement plan accounts starting in ). Please speak with your. A lack of income tax on distributions and no requirements for mandated withdrawals after 72! Withdrawal From an Inherited IRA. Inheriting an IRA can be a. When are IRA distributions not taxable? Qualified Roth IRA distributions are tax-free. How much do I have to withdraw from my IRA at age 70? If you withdraw from a traditional IRA or (k) before this age, those withdrawals are subject to a 10% early withdrawal penalty and taxation at ordinary. You can withdraw money any time after age 59½, but you'll need to pay income taxes on part or all of any IRA withdrawals you make. Step. 3. Savings growth vs. A new law effective last year makes the first $6, or distributions from retirement plans (like IRAs and (k)s tax-exempt for retirees age 65 and older in.

Who Pays Better Grubhub Or Doordash

Plus, you have the option to get paid the same day with Instant Cash Out or on Thursdays with direct deposit – whichever you prefer. Icon-HowItWorks-GetReady. Overall, Grubhub generally pays the most on average of all the delivery teams. However, to make even more from your drives, we recommend using the Para app. Uber Eats: Average is $ per hour. Couriers report less demand than DoorDash, but larger orders, higher pay, and better tips. Keep in mind. As a driver GrubHub pays 2x-3x more than doordash per order most times but doordash has far more market share around Longmont CO and you. Plus, you have the option to get paid the same day with Instant Cash Out or on Thursdays with direct deposit – whichever you prefer. Icon-HowItWorks-GetReady. DoorDash gives free deliveries on your first order, but you'll have to pay the service fee. Delivery fees range from $ to $, and the service fee is. DoorDash also has the highest cash out fee at $ , compared to UberEats, which is increasing to $ and Grubhub at 50 cents per cashout. UberEats allows. Of the top 3 common jobs between the two companies, DoorDash salaries averaged $8, higher than Grubhub. Same day pay, work on your time. Cons. Some. Postmates pays better than DoorDash and UberEats, now that's out of the way, let's check out why. Tips are the main reason, and they are based on the size. Plus, you have the option to get paid the same day with Instant Cash Out or on Thursdays with direct deposit – whichever you prefer. Icon-HowItWorks-GetReady. Overall, Grubhub generally pays the most on average of all the delivery teams. However, to make even more from your drives, we recommend using the Para app. Uber Eats: Average is $ per hour. Couriers report less demand than DoorDash, but larger orders, higher pay, and better tips. Keep in mind. As a driver GrubHub pays 2x-3x more than doordash per order most times but doordash has far more market share around Longmont CO and you. Plus, you have the option to get paid the same day with Instant Cash Out or on Thursdays with direct deposit – whichever you prefer. Icon-HowItWorks-GetReady. DoorDash gives free deliveries on your first order, but you'll have to pay the service fee. Delivery fees range from $ to $, and the service fee is. DoorDash also has the highest cash out fee at $ , compared to UberEats, which is increasing to $ and Grubhub at 50 cents per cashout. UberEats allows. Of the top 3 common jobs between the two companies, DoorDash salaries averaged $8, higher than Grubhub. Same day pay, work on your time. Cons. Some. Postmates pays better than DoorDash and UberEats, now that's out of the way, let's check out why. Tips are the main reason, and they are based on the size.

In order to make sure your listing is seen within GrubHub's app, restaurants may need to pay an extra 20% or more in “marketing commission” for that to happen. Postmates pays better than DoorDash and UberEats, now that's out of the way, let's check out why. Tips are the main reason, and they are based on the size. Winner: Grubhub for the guaranteed pay. Food delivery drivers with gig economy jobs had to eat most of their wait-time losses for a while. Whether a takeout. Delivery driver pay · Tips · Grubhub contribution · Missions & Special offers · How delivery partners get paid · Maximize your earnings · Have more questions about. As a driver GrubHub pays 2x-3x more than doordash per order most times but doordash has far more market share around Longmont CO and you. DoorDash is most highly rated for Work/life balance and Grubhub is most highly rated for Work/life balance. Learn more, read reviews and see open jobs. Uber Eats: Average is $ per hour. Couriers report less demand than DoorDash, but larger orders, higher pay, and better tips. Keep in mind. GrubHub is way better in my area and also pays more than door dash and Uber. Is this the same for where u live? Grubhub wins without a doubt. Doordash is around $ minimum. Uber eats is around $2. Grubhub is $3, but non tippers come up as $4 usually. Prices for Starbucks® items purchased through DoorDash, Grubhub or Uber Eats may be higher than posted in stores or as marked. Your delivery order may be. % of my tip goes to the tippee and then you take money out of their pay because I tipped them, that is fraud. Money is a fungible good. Delivery driver pay · Tips · Grubhub contribution · Missions & Special offers · How delivery partners get paid · Maximize your earnings · Have more questions about. Here's how it works: If the woman in the bathrobe had tipped zero, DoorDash would have paid me the whole $ better. We're committed to transparent. GrubHub pays drivers a base rate plus time spent and distance covered for each delivery. Like DoorDash and Uber Eats, drivers keep % of tips. They offer. Ubereats/doordash/grubhub? May 12, togo delivery fees for restaurants The minimum commission fee a restaurant pays when working with Postmates. DoorDash is most highly rated for Work/life balance and Grubhub for Drivers is most highly rated for Work/life balance. Learn more, read reviews and see open. Both GrubHub and DoorDash offer pros and cons as far as deliveries go; typically, GrubHub offers lower payments but greater stability in hourly rates. DoorDash also has the highest cash out fee at $ , compared to UberEats, which is increasing to $ and Grubhub at 50 cents per cashout. UberEats allows. According to the RideShare Guy, companies like UberEATS and Amazon Flex do it better than most. pay for any damages. Some insurance carriers do allow. Ubereats/doordash/grubhub? May 12, togo delivery fees for restaurants The minimum commission fee a restaurant pays when working with Postmates.

How Do You Pay Taxes On Ira Withdrawals

At retirement, the distributions will be tax-free. The Traditional IRA saver will pay taxes when they take distributions, but because they are not paying taxes. If all your IRA contributions were tax-deductible when you made them, the full amount of the RMD will be treated as ordinary income for the year in which you. The U.S. government charges a 10% penalty on early withdrawals from a Traditional IRA, and a state tax penalty may also apply. You can learn more at IRS. You will still pay income tax on the money, but a qualified early withdrawal will allow you to skip the 10% penalty. Another option for avoiding the early. Yes, any portion of your Roth IRA distribution that is included in your federal Adjusted Gross Income (AGI), is subject to Michigan individual income tax. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. Withdrawals from traditional IRAs are taxed as regular income, based on your tax bracket for the year in which you make the withdrawal. NEXT: Where should I. Early Withdrawal Penalties for Traditional IRAs. There is a 10% additional tax on early withdrawals from your traditional IRA. You can receive distributions. At retirement, the distributions will be tax-free. The Traditional IRA saver will pay taxes when they take distributions, but because they are not paying taxes. If all your IRA contributions were tax-deductible when you made them, the full amount of the RMD will be treated as ordinary income for the year in which you. The U.S. government charges a 10% penalty on early withdrawals from a Traditional IRA, and a state tax penalty may also apply. You can learn more at IRS. You will still pay income tax on the money, but a qualified early withdrawal will allow you to skip the 10% penalty. Another option for avoiding the early. Yes, any portion of your Roth IRA distribution that is included in your federal Adjusted Gross Income (AGI), is subject to Michigan individual income tax. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. Withdrawals from traditional IRAs are taxed as regular income, based on your tax bracket for the year in which you make the withdrawal. NEXT: Where should I. Early Withdrawal Penalties for Traditional IRAs. There is a 10% additional tax on early withdrawals from your traditional IRA. You can receive distributions.

the taxable portion and the excludable portion of an IRA withdrawal for your New Jersey Income Tax return. The portion of your IRA withdrawal that is taxable. If you take any withdrawals before age 59½, they'll be hit with a 10% penalty tax unless an exception applies. (See “How to Avoid the Early Withdrawal Tax. Illinois does not tax the amount of any federally taxed portion (not the gross amount) included in your Form IL, Line 1, that you received from. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. · There are. IRA distributions are generally included in the recipient's gross income and taxed as ordinary income, other than qualified distributions from a Roth IRA. For a. When you withdraw money from your IRA or employer-sponsored retirement plan, your state may require you to have income tax withheld from your distribution. Those dollars may be rolled into an IRA, perhaps at retirement or after a change in jobs. An IRA rollover can maintain the tax deferral. Ultimately, those. When you withdraw from a traditional IRA before age 59½, you'll pay a 10% federal penalty tax as well as tax on the withdrawal amount. The entire amount is. If you receive a non-qualified distribution from your Roth IRA, the earnings portion of such distribution generally will be subject to ordinary income tax, plus. Taxes on Pension Income You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, (k)s, When you withdraw the money, presumably after retiring, you pay no tax on the money you withdraw or on any of the gains your investments earned. That's a. You can withdraw money any time after age 59½, but you'll need to pay income taxes on part or all of any IRA withdrawals you make. withdrawal from a tax-. You will pay taxes every time you make a withdrawal. Failing that, you should pay quarterly estimated taxes. Failing that, you will owe taxes April 15 of the. Through the Electronic Funds Transfer service, you can withdraw from your IRA. When in doubt about an order in an IRA, consult your tax advisor before placing. If you take a cash distribution from your IRA, you'll have to pay income taxes on the taxable amount you withdraw unless you subsequently indirectly roll that. tax-deductible for federal income tax purposes, and there is no age limit for making contribu- tions. Generally, Roth IRA withdrawals are not taxable for. Withdrawals from the NYCE IRA are eligible for a $20, annual New York State and New York City income tax exemption. This $20, exemption is applied against. But when you take withdrawals during retirement, you'll have to pay income taxes on them. And depending on your income tax rate, that could eat into. Withdrawing from an IRA? See how your age and other factors impact the way the IRS treats your withdrawal. Qualified dividends and capital gains distributions are taxed at more favorable long-term capital gains tax rates. You also pay taxes when you sell an.

Anwpx Stock Price

New Perspective Fund (Class A | Fund 7 | ANWPX) seeks to provide long-term growth of capital For Class A Shares, this chart tracks the high and low prices at. ANWPX Fund, USD %. At this time The successful prediction of New Perspective stock price could yield a significant profit to investors. American Funds Inc ANWPX:NASDAQ · 52 Week High · 52 Week High Date08/30/24 · 52 Week Low · 52 Week Low Date10/27/23 · Dividend Yield · Net Assets. A high-level overview of American Funds New Perspective Fund® A (ANWPX) stock. Stay up to date on the latest stock price, chart, news, analysis. Analyze the Fund American Funds New Perspective Fund ® Class A having Symbol ANWPX for type mutual-funds and perform research on other mutual funds. Historical stock closing prices for American Funds New Perspective Fund® A (ANWPX). See each day's opening price, high, low, close, volume, and change %. Discover historical prices for ANWPX stock on Yahoo Finance. View daily, weekly or monthly format back to when American Funds New Perspective A stock was. Category World Large-Stock Growth. Performance Rating Above Average. Risk Rating Average. Stock Exchange NASDAQ. Ticker Symbol ANWPX. Index MSCI AC World NR USD. T. Rowe Price Blue Chip Growth Fund, Inc. $ + +%. New Perspective Fund (Class A | Fund 7 | ANWPX) seeks to provide long-term growth of capital For Class A Shares, this chart tracks the high and low prices at. ANWPX Fund, USD %. At this time The successful prediction of New Perspective stock price could yield a significant profit to investors. American Funds Inc ANWPX:NASDAQ · 52 Week High · 52 Week High Date08/30/24 · 52 Week Low · 52 Week Low Date10/27/23 · Dividend Yield · Net Assets. A high-level overview of American Funds New Perspective Fund® A (ANWPX) stock. Stay up to date on the latest stock price, chart, news, analysis. Analyze the Fund American Funds New Perspective Fund ® Class A having Symbol ANWPX for type mutual-funds and perform research on other mutual funds. Historical stock closing prices for American Funds New Perspective Fund® A (ANWPX). See each day's opening price, high, low, close, volume, and change %. Discover historical prices for ANWPX stock on Yahoo Finance. View daily, weekly or monthly format back to when American Funds New Perspective A stock was. Category World Large-Stock Growth. Performance Rating Above Average. Risk Rating Average. Stock Exchange NASDAQ. Ticker Symbol ANWPX. Index MSCI AC World NR USD. T. Rowe Price Blue Chip Growth Fund, Inc. $ + +%.

New Perspective Fund, Class A S (ANWPX) - Price History ; June , $, $ ; May , $, $ ; April , $, $ ; March , $ Real time New Perspective Fund (ANWPX) stock price quote, stock graph, news & analysis. In pursuing its investment objective, it invests primarily in common stocks that the investment adviser believes have the potential for growth. Market Cap. The. Search for Stocks, ETFs or Mutual Funds. Search. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. American Funds New Perspective Fund® Class A. View the latest American Funds New Perspective Fund;A (ANWPX) stock price, news, historical charts, analyst ratings and financial information from WSJ. T. Rowe Price Instl Global Equity, TRGSX, % ; Vanguard Global Equity Inv, VHGEX, % ; Vanguard Total World Stock Index Fund Institutional Shares, VTWIX. Investment style (stocks), Market Cap: Large Investment Style: Growth ; Launch date, ; Price currency, USD ; Domicile, United States ; Symbol, ANWPX. , Expense Ratio: Annual Report | Fee Level Comparison Group: World Stock Front Load. Other Fees. Management Actual. %. Management Maximum. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded. Latest American Funds New Perspective Fund® Class A (ANWPX) share price with interactive charts, historical prices, comparative analysis, forecasts. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the. Low commission rates start at $0 for U.S. listed stocks & ETFs*. Margin loan rates from % to %. Open An Account. View Disclosure. 2. Gemini · logo. The New Perspective Fund, Class A Shares (ANWPX) is a mutual fund that aims to provide investors with a diversified portfolio of global equities. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at. Get American Funds New Perspective Fund® Class A (ANWPX.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading. ANWPX - New Perspective Fund - American Funds New Perspective Fund Class A Stock - Stock Price, Institutional Ownership, Shareholders (MUTF). This fund has multiple managers, view ANWPX quote page for complete information. Rowe Price Global Stock Fund (12/95). PRGSX. Dividend history for stock ANWPX (New Perspective Fund, Class A S) including historic stock price and split, spin-off and special dividends. New Perspective. stock price has recovered. High Yield. Yields over 4% ››. Stocks, ETFs, Funds ANWPX % Rank. Stocks, %, %, %, %. Cash, %, Get the latest New Perspective Fund Shares (ANWPX) price, news, buy or sell recommendation, and investing advice from Wall Street professionals.

Walmart Money Card Atm Check Deposit

This option allows you to add money to your card at Walmart locations for a $3 fee. Cash deposits are free using the Walmart MoneyCard app at Walmart stores. Check out our easy to understand fee breakdown: · Early Direct Deposit · In-Network ATM Withdrawals · Card Transactions Fee · Inactivity Fee · Send Money to Bluebird. Just snap a pic & the money is added to your account within 5 business days free of charge Download the Walmart MoneyCard App today. Apple store Google store. Today the company and Green Dot (NYSE: GDOT) announced the launch of an innovative new service enabling customers to securely deposit and withdraw cash in. Select Deposit & then Deposit A Check. Make sure the check is made out to you, sign your name on the back, & write "For mobile deposit only" underneath your. You can add $$1, to your card. Give the cash you want to deposit to the Associate, including the $3 fee. Your deposit will be reflected in your. Log in to your Walmart MoneyCard app & tap Deposit. · Log in to your Walmart MoneyCard app & tap Deposit. · Tap Deposit Cash. · Tap Deposit Cash. · Tap Create a. Easily manage & access your money. New Walmart MoneyCard accounts now get: • Get your pay up to 2 days early with direct deposit.¹ • Earn cash back. If you can deposit a check like that in an ATM, and your bank does not prohibit that, then you should be able to deposit it. The best thing to. This option allows you to add money to your card at Walmart locations for a $3 fee. Cash deposits are free using the Walmart MoneyCard app at Walmart stores. Check out our easy to understand fee breakdown: · Early Direct Deposit · In-Network ATM Withdrawals · Card Transactions Fee · Inactivity Fee · Send Money to Bluebird. Just snap a pic & the money is added to your account within 5 business days free of charge Download the Walmart MoneyCard App today. Apple store Google store. Today the company and Green Dot (NYSE: GDOT) announced the launch of an innovative new service enabling customers to securely deposit and withdraw cash in. Select Deposit & then Deposit A Check. Make sure the check is made out to you, sign your name on the back, & write "For mobile deposit only" underneath your. You can add $$1, to your card. Give the cash you want to deposit to the Associate, including the $3 fee. Your deposit will be reflected in your. Log in to your Walmart MoneyCard app & tap Deposit. · Log in to your Walmart MoneyCard app & tap Deposit. · Tap Deposit Cash. · Tap Deposit Cash. · Tap Create a. Easily manage & access your money. New Walmart MoneyCard accounts now get: • Get your pay up to 2 days early with direct deposit.¹ • Earn cash back. If you can deposit a check like that in an ATM, and your bank does not prohibit that, then you should be able to deposit it. The best thing to.

How do I deposit cash with my One debit card at Walmart? · Take your One debit card to any Walmart Money Center, cashier, or Customer Service Desk · Let the. Direct Deposit: You can have your pay check or government check automatically deposited to your card. This service is free. Online Bank Transfer: You can. Paper Money Deposits are currently supported at the following merchants: *For deposits at Walmart, see your store's customer service desk or MoneyCenter. Walmart MoneyCard. likes · talking about this. Learn more about Walmart MoneyCard: yoga-dlya-novichkov.ru Select the "Deposit Check" option and follow the prompts to complete your deposit. It's a quick and easy way to add money to your card. Managing your money has. Select the "Deposit Check" option and follow the prompts to complete your deposit. It's a quick and easy way to add money to your card. Managing your money has. Use the Money Network Locator to search and find locations where you can cash checks for free 1, reload 2 your Card 3 and have access to surcharge-free ATMs. The Walmart MoneyCard is a demand deposit account that works just like a check card or debit card. check your cash back rewards & find the closest ATM. No overdraft fees · 2% annual interest · Free cash reloads using the Walmart app · ASAP Direct Deposit · Free family accounts. Users can withdraw cash from Walmart MoneyCenters and Customer Service desks at no extra charge. This card does not charge any overdraft fees. If you order a. Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal, One & more options available. Just wondering if I should grab a prepaid card and take it to an atm, check amount about will it clear or will there be issues? If you can deposit a check like that in an ATM, and your bank does not prohibit that, then you should be able to deposit it. The best thing to. Bring your preprinted check and prepaid card to any Walmart register and cash your check. Money will typically be available on your card and ready to use within 10 minutes when you cash and deposit a check at Walmart. Mobile deposit. Take a pic of your check & see your money deposited into your account free of charge within 5 business days. Reloadable: You can add money to your card through various methods, including direct deposit, cash reload at Walmart stores, and mobile check. Earn up to $75 cash back every year on your Walmart purchases. Learn about the Walmart MoneyCard reloadable debit card account, click here! Enter address, city or ZIP code to find an ATM near you. GO. Account. Open an account · Activate your card · Download app · Direct Deposit. Easily manage & access your money. New Walmart MoneyCard accounts now get: Get your pay up to 2 days early with direct deposit. ¹. Earn cash back.

What Is A Good Apr For Student Loan

The current day SOFR Average is % which may adjust monthly. Your actual student loan interest rate may be different than what is shown in the examples. Also, some of the directories rank loans by the best advertised rates or average rates, as opposed to the actual rates. Featured Student Loan Comparison Sites. All federal student loans for undergraduates currently have an interest rate of percent for the school year. Federal Student Loan Interest Rates ; Direct Loans (both subsidized and unsubsidized), Undergraduate, % ; Direct PLUS Loans, Parents, %. Now you could get student loan refi rates starting at % variable APR with discounts when you open a Laurel Road Linked Checking® account and set up. Despite having a 0% interest rate, it's essential to continue paying your student loan. the best solution. Filing a bankruptcy or consumer proposal. Key Takeaways · Interest rates are % for new federal undergraduate loans, % for graduate loans, and % for parent PLUS loans. · Private student loan. Parents and graduate students may be eligible for PLUS loans, another type of federal student loan. At %, these have the highest interest rate of any. Federal student loan interest rates are as low as %, and private loans start around %. But what does it really cost to borrow? Origination fees and. The current day SOFR Average is % which may adjust monthly. Your actual student loan interest rate may be different than what is shown in the examples. Also, some of the directories rank loans by the best advertised rates or average rates, as opposed to the actual rates. Featured Student Loan Comparison Sites. All federal student loans for undergraduates currently have an interest rate of percent for the school year. Federal Student Loan Interest Rates ; Direct Loans (both subsidized and unsubsidized), Undergraduate, % ; Direct PLUS Loans, Parents, %. Now you could get student loan refi rates starting at % variable APR with discounts when you open a Laurel Road Linked Checking® account and set up. Despite having a 0% interest rate, it's essential to continue paying your student loan. the best solution. Filing a bankruptcy or consumer proposal. Key Takeaways · Interest rates are % for new federal undergraduate loans, % for graduate loans, and % for parent PLUS loans. · Private student loan. Parents and graduate students may be eligible for PLUS loans, another type of federal student loan. At %, these have the highest interest rate of any. Federal student loan interest rates are as low as %, and private loans start around %. But what does it really cost to borrow? Origination fees and.

Direct subsidized (graduate students): %; PLUS Loan (graduate students and parents of undergraduate students): %. Private student loan interest rates. According to the CBO's baseline projections, federal student loan rates could be as high as % for Direct Subsidized and Unsubsidized Loans to undergraduate. Current Federal Student Loan Interest Rates ; Interest rates for fixed-rate undergraduate subsidized Federal Direct Loans · % · % · % · % ; Interest. Federal student loan interest usually falls below 10%. Some students may qualify for federal subsidized loans, where the loan is interest-free while the student. The current federal student loan interest rate for undergraduates is %. · Graduate student and parent PLUS loans have fixed interest rates of % and %. Are lower interest rates the best route to a fairer, more effective student loan program? From the rhetoric heard in Congress and on the campaign trail, the. Read our full SoFi student loans review. *Interest Rates: Eligibility and Important Details. Fixed rates range from % APR to % APR with a % autopay. Direct subsidized (graduate students): %; PLUS Loan (graduate students and parents of undergraduate students): %. Private student loan interest rates. Interest rates for private student loans are credit based. Therefore, the interest rate is not the same for every borrower. The APR will be determined after an. Student Loan or other government student loans. All you need to do is enter the total amount of your loan(s), choose an interest rate interest rate at. Average private student loan interest rates ; · % · % · $10, up to total refinance amount ; · % · % · $5, - $, ; · %. See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school. Find the Best Private Student Loans for September Compare student loan fixed interest rates from % and variable interest rates from %. The federal student loan interest rates are currently % for undergraduate loans, % for unsubsidized graduate loans and % for direct PLUS. Private student loans can help pay for your education, but be sure to shop around for the best deal. See rates from LendingTree's top student loan lenders. Compare private student loan interest rates and lenders to find the right financing option for your college expenses. Interest rates on the Student Line of Credit and Quebec student loan ; Variable rate. P + % = % ; * Interest rate on Quebec student loans with interest. Current Rates Current Rates ; Private Student Loan Undergraduate - Variable Rate · $ · % · % ; Private Student Loan Undergraduate - Fixed Rate · $ Current Student Loan Interest Rates ; Federal Direct Stafford Student Loans for undergraduate students, % for loans first disbursed between July 1, – Interest rates might be higher and interest payments begin while still in school. – May not cover all education-related expenses, – Requires good credit.